MSMEs gain boost from Aatmanirbhar Bharat Abhiyan economic package amidst lockdown

May 15, 2020 1:51 pm

Honourable Prime Minister Narendra Modi in his recent public address announced the Aatmanirbhar Bharat Abhiyan economic package that is aimed at boosting the national economy by infusing liquidity and promoting local manufacturing. Finance Minister Nirmala Sitharaman discussed the first instalment of the ₹20 lakh crore package with a focus on the MSME sector.

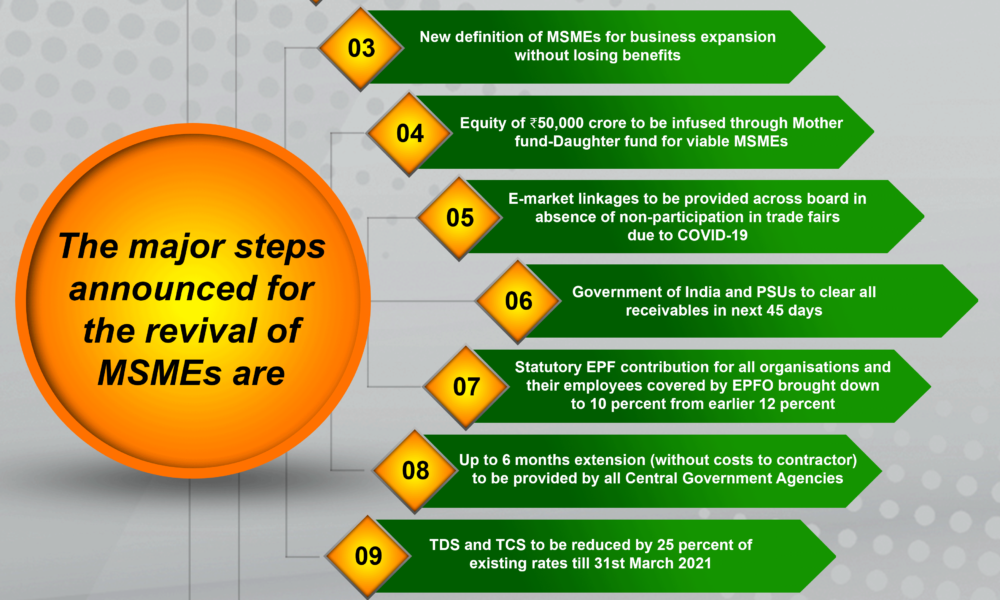

Stating that the package rests on the five pillars of Economy, Infrastructure, Technology-driven systems, Demography, and Demand, the Finance Minister added that the focus will be on the factors of production, i.e., Land, Labour, Liquidity, and Laws. The major steps announced for the revival of MSMEs are as follows:

• Collateral-free loan of ₹3 lakh crores for MSMEs will aid 45 lakh MSME units so that they can resume operations and protect jobs.

• Subordinate debt provision of ₹20,000 crores will benefit 2 lakh MSMEs that are NPAs or stressed assets.

• Under the new definition of MSMEs (Micro units with investment till ₹1 crore and turnover up to ₹5 crores; Small units with investment till ₹10 crores and turnover up to ₹50 crores; and Medium units with investment till ₹20 crores and turnover up to ₹100 crores), MSMEs can work on expansion without losing benefits. There will also be no distinction between manufacturing and service sector MSMEs.

• Equity of ₹50,000 crore will be infused through Mother fund-Daughter fund for MSMEs that are viable but need aid. A fund of funds with a corpus of ₹10,000 crore will be set up to help such MSMEs increase capacity and be listed on markets if they choose.

• E-market linkages will be provided across the board in the absence of non-participation in trade fairs due to COVID-19. The government of India and PSUs will clear all receivables in the next 45 days.

• To infuse ₹6,750 crore liquidity into organisations, the statutory EPF contribution for all organisations and their employees covered by EPFO has been brought down to 10 percent from the earlier 12 percent. This is not applicable to government organisations.

• Up to 6 months extension (without costs to contractor) will be provided by all Central Government Agencies like Railways, Ministry of Road Transport & Highways, and Central Public Works Dept.

• Tax Deducted at Source (TDS) and Tax Collection at Sources (TCS) will be reduced by 25 percent of existing rates till 31st March 2021, which will release ₹50,000 crores.

• Due date of all Income Tax Return filings is extended from 31st July to 30th November, and Vivaad se Vishwas scheme has been extended till 31st December 2020. Date of assessments getting barred as on 30th September 2020 is extended to 31st December 2020, and date of assessments getting barred as on March 31, 2021 is extended to 30th September 2021.

• As Indian MSMEs and other companies have often faced unfair competition from foreign players, global tenders will be disallowed in government procurement tenders up to ₹200 crore.

In light of this announcement, Sagar Shah, Co-founder, Sahas Softech LLP told us his views with respect to the impact of the package on the manufacturing and automobile sector, particularly 3D printing, by saying, “The Finance Minister’s announcement about equity infusion of ₹50,000 crores for potential MSMEs and the major change in global tender policy is very encouraging for expansion plans. In the post COVID scenario, 3D printing will spearhead the strengthening of manufacturing and automobile sector. Few big companies in our country already have in-house 3D printers, which help them to innovate their products according to their requirement. But due to the pricing, many sectors still choose to outsource. This measure will surely strengthen our sector in expansions.”

Maxson Lewis, Managing Director, Magenta Power, shared, “The Finance Minister’s announcement focused towards MSMEs is the right approach. Making capital available to the MSME sector which is the biggest employer is welcome. The EPF contribution will make sure money will go to people who are working for it. Cash infusion is required at the bottom of the pyramid.”

Mehernosh Tata, Head Edelweiss SME Lending, Edelweiss too discussed with us his opinion on the announcement by stating, “The economic relief package announced by the government focuses extensively on the MSME sector. MSMEs are the local backbone of the Indian economy at the grass-roots level. This move is welcome and much-needed for the MSME sector, and will go a long way in lifting the sentiment and morale of this very important segment. The package has been extremely well-thought-out, both from a sustenance and liquidity point of view. The announcement of payment of receivables within 45 days to all MSMEs by the government of India and CPSEs will provide requisite liquidity in the hands of entrepreneurs. Restricting tenders less than ₹200 crores only to Indian entities provides a great opportunity for MSMEs to get incremental work orders, especially when demand may slump in the near future.”

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

English

English Hindi

Hindi