Lubrication market growth acceleration capitalises on performance

October 12, 2021 4:33 pm

Pandemic exposed many challenges for the lubricants industry by impacting both the transportation and industrial sectors. Major economies of each region are affected due to pandemics and this has resulted in a slowdown in activities across the industries that use lubricants in their machinery and equipment.

The global automotive supply industry is heavily impacted by the pandemic crisis, as both the production and sales of motor vehicles came to a sudden halt in most of the regions. According to the OICA, the voice speaking on automotive issues in world forums: automobile production declined by around 23 percent in the first nine months of 2020 compared to the same period in 2019. This negatively affected the demand for lubricants in 2020. The market is expected to recover from 2021 onwards with industrial and transportation activities getting back on track and functioning with full capacity.

The requirement of lightweight components in the automotive industry has led to an increase in the application of die-cast components in vehicles. Further, the use of lightweight metals, such as aluminum and magnesium, has increased in the automotive industry, and are likely to continue the high growth rate. For the manufacturing of components, with these materials, manufacturers are increasingly opting for HPDC, due to its compliance with features, like high-quality and ease of manufacturing complex shapes. The market for plunger lubricants is forecast to be the fastest-growing market under die casting lubricants, fueled by the spike in demand for high-pressure die casting, especially from the automotive industry.

Overview: Lubricants solutions market

Lubricants are majorly used as diesel engine oils, gearbox and transmissions in passenger cars, commercial vehicles and motorcycle segments of the automotive sector. Growing automobile sales are expected to augment the global industry growth over the forecast period. Global automotive sales have been on the rise primarily driven by countries, such as India, China, the U.S., and Brazil.

Lubricants market by application: Grandview research Report mentions, the global lubricants market size was valued at USD 125.81 billion in 2020 and is expected to grow at a CAGR of 3.7 percent from 2021 to 2028. The industry dynamics are changing, in terms of raw material, owing to the rising demand for bio-based lubricants. The growing trade of vehicles and their spare parts is anticipated to fuel the demand for automotive oils and greases. The major economic recovery in North America and Europe is expected to boost the consumer vehicles segment, which, in turn, is a boon for the market. Typical lube manufacturers use crude oil, CBM, tight oil, and other additives to formulate all types of lubricants. Major companies have integrated their business operations globally. It ensures a steady raw material supply to manufacture mineral oils & additives needed for production.

Market by base oil:

Markets And Markets study indicate, the global lubricants market size is projected to reach USD 182.6 billion by 2025 from USD 157.6 billion in 2020, at a CAGR of 3.0 percent. Growth in Industrialisation in Asia Pacific and the Middle East & Africa, coupled with the rise in process automation in most of the industries and the gradual increase in the number of vehicles on-road are key factors expected to drive the global lubricants industry during the forecast period.

“The base oil industry is going through a transition from old to new technology. Chevron invented and licensed this new technology and has played a leadership role in nurturing it to where it is today. We are perceived as an industry icon worldwide because of our success with this technology and our market rollout.”-Brent Lok, Manager, Base Oil Marketing and New Product Development, Chevron North America Products.

Mining lubricants market:

The mining lubricants market was valued at USD 1.95 billion in 2016, and is projected to reach USD 2.56 billion by 2022, at a CAGR of 4.5 percent from 2017 to 2022. The growth of the mining lubricants market is driven by the increasing demand from the Asia-Pacific region and growing end use industries, such as coal and iron ore mining. Moreover, the demand for high quality and high performance lubricants is expected to further fuel the growth of the mining lubricants market during the forecast period. Mining-related investments are expected to decrease in the coming years in countries such as Australia and South Africa, which would eventually hamper the growth of the mining lubricants market.

Forging Lubricant market:

The global forging lubricants market is estimated to expand at a CAGR of 5.6 percent over the forecast period of 2021-2031. The research by Persistence Market Research further mentions, rising need to increase efficiency of manufacturing processes and lower manufacturing costs has led to adoption of metalworking machines in several industries, including processing, automobiles, and other heavy metal industries, which, in turn, has benefitted manufacturers of forging lubricants to a great extent.

The global market for forging lubricants is expected to grow substantially owing to the steady growth of metal machinery industries in developing regions such as South Asia Pacific and East Asia. Additionally, key players are emphasising on improving the formulations of forging lubricants. For instance, the forging process will lower cost, be more consistent, and also more energy-efficient and environmentally friendly. Demand for forging lubricants is also being driven by increased activity in the metal forging industry across the world due to numerous uses in the automotive industry for developing lightweight vehicles and the added benefit of stronger automotive components manufactured by forging than those manufactured by casting or machining.

Lubricant Additives market:

Lubricant additives are chemicals used for enhancing the functioning of lubricating oils by helping the engine oil to stay longer and making the engine safe under all operating conditions. They typically range between 0.1 percent to 30 percent of the oil volume, depending on the application. The global lubricant additives market will reach a value of around US$ 15 Billion in 2020. Looking forward, IMARC Group expects the market to grow at a CAGR of 2.7 percent during 2021-2026. Additives can be of various types, some additives impart new and useful properties to the lubricant, whereas others enhance properties that are already present. Some lubricants also act to lower the rate at which unwanted changes take place in the product throughout its service life. A number of factors are currently catalysing the global demand for lubricant additives.

Market Dynamics: Growth drivers

Growing prominence for bio-lubricants is likely to act as an opportunity in the future. The industry is characterised by a high number of new market entrants that are seeking to tap the lucrative opportunities in the global market; while existing players are entering into strategic collaborations to increase capacities & expand their reach into emerging markets. The joint venture, merger, and acquisition activities in the industry have increased significantly over the past decade. Companies constantly seek to establish long-term contract agreements with trusted partners for sustainable business operations globally increased demand for high performance engines leading the lubricant industry to evolve and grow.

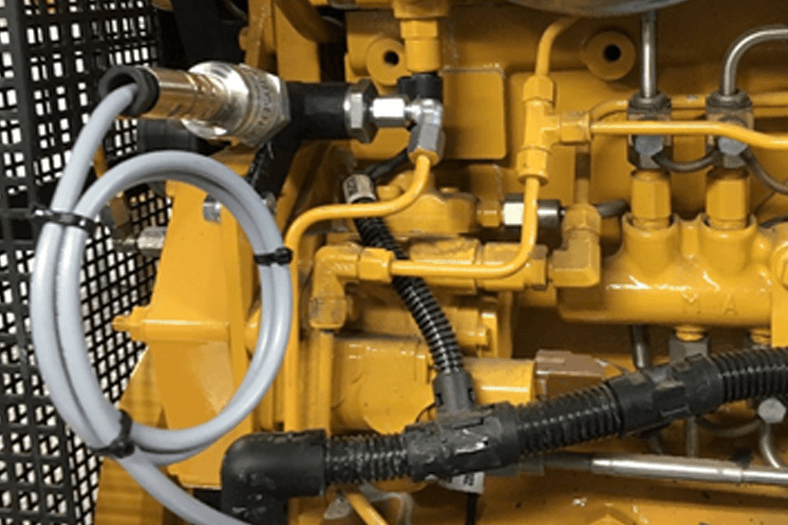

Engine oil dominated the market, and it is expected to grow during the forecast period, as it is widely used to lubricate internal combustion engines. Since the first commercial car was developed by Ford in the early 20th century, the design of internal combustion engines has evolved significantly. The internal elements of the engine are now exposed to much more tension and heat due to engine improvement. This also led to very high RPM engines which require better quality engine oil. Apart from this, the transmission system inside a vehicle has also improved with vehicles reaching up to 150 miles per hour. The gear system and bearing technology have also improved. All these improvements and evolution necessitates better lubricants. This has led the lubricants to evolve and expand.

High growth in manufacturing and demand for renewable energy are the opportunities emerging in the lubricants market.

The power industry is a large consumer of industrial lubricants, ranging from turbine oil to transformer oil. Lubricants are used in various operations. The renewable energy industry is a prospective sub-segment of the power generation industry. Currently, wind power generation accounts for a very small share in the overall energy mix, but the sector is growing at a rate of 10 percent. Wind turbines require lubricants for optimum operability. Growth drivers for the manufacturing sector in these markets include favorable foreign investment norms, availability of a large pool of skilled labor & technological know-how. High growth in niche manufacturing sectors, such as 3D printing & medical devices, is expected to further complement the industrial growth in these markets. Hence, rapid industrialisation in BRICS is expected to drive industrial fluids demand, which, in turn, is expected to complement the global lubricant sector’s growth.

Based on the application, the market is segmented into transportation and industrial lubricants. The demand for lubricants is high in the transportation segment due to the rise in the number of vehicles on the road in China and the rising transportation demands in India and ASEAN.

Forging lubricant demand is projected to be driven by steady expansion in the metals & machinery sector, notably in emerging nations such as India, China, Brazil, and others. Developing economies such as those in Asia Pacific and East Asia are expected to witness a steady increase in demand for forging lubricants. Graphite-free forging lubricants are projected to dominate global forging lubricant demand. These lubricants cool the die, thereby helping in thermal management. Water-based forging lubricants are projected to dominate as they help the die to cool and are easier to use with application equipment. Use of aluminum for the manufacturing of lightweight automotive components is projected to expand at a significant CAGR, which, in turn, would lead to growing requirements for forging lubricants.

In the short term, a major factor driving the market studied is the increasing demand for high-performance lubricants owing to their better and improved properties, such as reduced flammability, reduced gear wear, and increased service life.

Lubricant additives

Many lubricant additives contain anti-wear, anti-rust or anti-corrosive characteristics, which prevent damage to coatings and surfaces inside the engine. Additives with antioxidant properties aid in slowing down the oxidation process and the build-up of unwanted engine contaminants and oil thickening. They also help in keeping the engine surfaces and parts clean along with controlling deposit mediated engine oil thickening.

Additives with friction or viscosity modifying properties can also help in increasing the fuel economy. This is by decreasing the friction between moving surfaces or allowing favourable viscosity profiles that further provide improved efficiency. Advanced lubricant additives also benefit the environment as they can aid in reducing carbon dioxide emissions from vehicles and also allow the effective use of energy resources.

Regions for market dominance

Asia Pacific dominated the global market with a volumetric share of over 43 percent in 2020 and will expand further at the fastest CAGR from 2021 to 2028, in terms of volume as well as revenue. This is attributed to the increasing growth in the base oil movement, rapid industrialisation & urbanisation, rising population, and high growth in major end-use industries, such as textiles, chemicals, food processing, and metalworking. The largest consumption is coming from countries such as China and India. APAC is expected to account for the largest share in the global lubricants industry during the forecast period, in terms of both volume and value. The increasing population in the region, accompanied by rising spending in the industrial sector and infrastructural developments in the developing markets of China, India, and Indonesia, is projected to make this region an ideal destination for the lubricants industry.

Europe has a high growth potential for industrial lube products due to rapidly growing chemical manufacturing facilities in the region. The heavy growth is largely driven by the intervention of several multinational chemical manufacturers across countries, such as Russia, the U.K., France, and Germany. These industrial lubes are by and large utilised for multiple applications, such as the production of fertilizers, rotatory as well as compressor units in manufacturing units, and more, which helps in a multiple-fold increase in operating cycle as well as the performance of machinery that undergo severe stress.

Latin America is projected to formulate several trade strategies to attract Foreign Direct Investment (FDI) for infrastructure development. Various policies to promote investment and partnerships with the private sector have been formulated to address port and transportation infrastructure opportunities across the region.

Conclusively, most MEA countries are highly dependent upon crude oil production and the consequent revenue generated from this industry. Numerous countries in this region have undertaken efforts to diversify their economies in an attempt to reduce the dependency on crude oil. This, in turn, has fostered industrial development and boosted the demand for industrial machinery supporting market growth.

Key players as well as new entrants are focusing on the development of bio-lubricants, owing to the future concerns of energy security for petroleum products. However, bio-lubricants, being in the immature phase, have certain restrictions, such as temperature resistance and oxidative stability. Thus, companies are investing in R&D activities for these products. Moreover, the global Aerospace Lubricant market is also anticipated to witness significant growth and the insights point towards the innovative trends in the market and help in forming strategies to be implemented in the future for better reliability and performance indicative of growth acceleration and opportunities in the market.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

English

English Hindi

Hindi