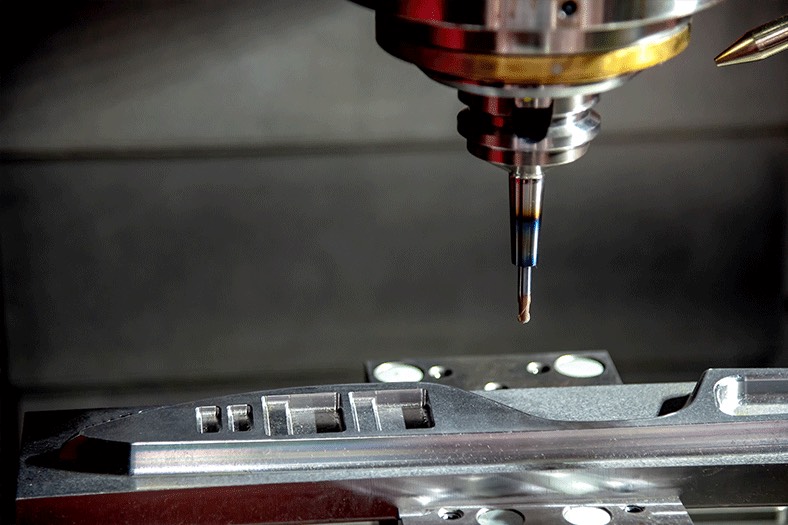

Technological upgradation for precision manufacturing through dies and moulds

April 15, 2020 3:33 pm

Manufacturers discuss technical innovations happening in the die and mould market for enhanced performance in the automotive and tooling industries.

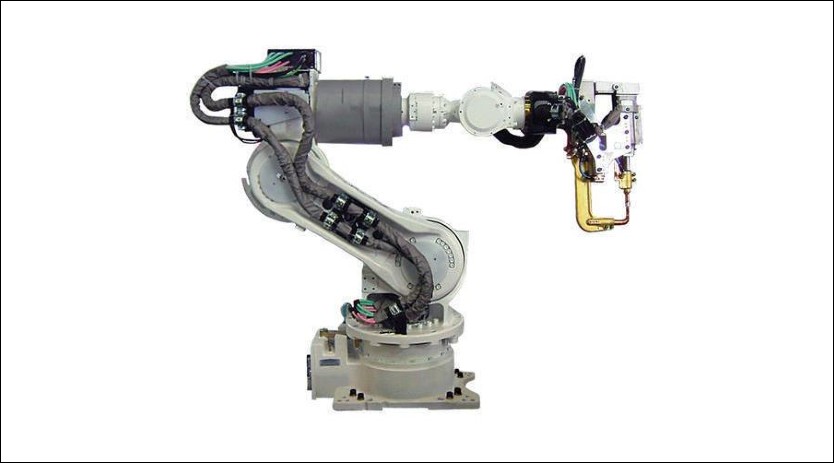

Over the past two decades, there has been a significant increase in adoption of industry robotics in the manufacturing industry. Industrial robots in manufacturing processes offer high efficiency, higher flexibility, reduced cycle time, and enhanced precision in the final product output. Moreover, automation in die and casting process is expected to propel the growth of die and mould market in India during 2018–2022.

Market potential for dies and moulds in India

The dies and moulds market in India is expected to grow at a CAGR of close to 9 percent between 2018 and 2022. While the die and mould industry has grown year-on-year in India, the past eight months have eroded quite a number of orders due to economic uncertainty in the global markets. This has definitely had a cascading effect on the D&M industry here; the next few months too will be unpredictable, given the outbreak of COVID-19 across the globe and in India.

According to Vineet Seth, Managing Director – South Asia & Middle East, Mastercam APAC, the demand is constantly increasing; however, the quality of software and equipment needs to be upgraded across most tool rooms in the country. Time required to deliver is extremely critical in the D&M sector, and addition of world-class software and equipment will bring orders back to the industry.

Catering to the automotive market with latest innovations

The automotive market is highly sensitive about price and time. The innovations in die and mould for the automotive market are largely structured around these two heads. While dies, moulds, jigs, and fixtures are broadly classified as “tooling”, in essence, they are the means to manufacture or assist with the manufacturing of other parts or components. It is, therefore, important to note how tool and die makers are utilising the innovation in the manufacture of such tooling.

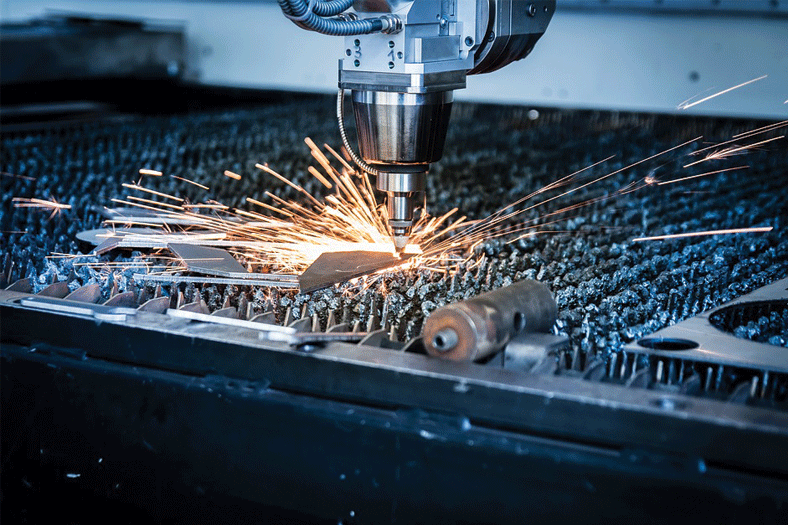

While there is a modular structure to most tools and dies, a large part of time and money goes into the manufacture of critical parts of these dies and moulds, namely the cores, cavities, cams, ejectors, injectors, etc. There has been little innovation in the raw materials for these in the past two decades. However, machining is a critical aspect of the entire mould making process, and therein lies the larger part of savings in time and money.

Tool path machining strategies like DynamicMachiningTM for mills and lathes have more than halved the time taken to rough machine these critical parts. Making efficient use of flute length and face of solid carbide tools, DynamicMachiningTM maintains a near uniform cut using the principles of radial chip thinning by reducing sharp turns, introducing trochoids and straight lines, as well as reducing high engagement with the tool in the roughing passes. This one strategy accounts for over 67 percent in savings in certain cases.

Auxiliary savings include reduced tool wear, reduced localised work hardening and an increase in machine life/longevity. Gautam K. Ahuja, Managing Director, Dormer Pramet Pvt. Ltd., on this note, talks about the standard features in dies and moulds that are used for automotive. “Owing to industry’s varied nature, end users would require intense technical support and advice to acquire the right high-quality tooling. To help its customers build knowledge and expertise, Dormer Pramet has developed a dedicated team for the die and H13 segment. Our die and mould range features both indexable and solid tooling. This means that we can provide cutting tools for a wide range of operations. Our milling assortment provides the bulk of this offer, from heavy roughing through to fine finishing. The programme includes copy milling, face milling, shoulder milling, and high feed milling cutters.”

As part of its expansion into the die and mould segment, Dormer Pramet has built a comprehensive high feed milling assortment with several recent introductions. The SBN10 cutters, with its unique pocket design, from roughing to finishing, are suitable for a variety of milling operations. A range of diameters are available from 16–42 mm, with multiple design options. This cutter is further supported by a range of BNGX10 inserts, for depths of cut up to 1 mm. The patented double-sided insert with four cutting edges provides a highly cost-effective and versatile option. Additionally, the new double-sided SNGX11 insert supports high feed milling up to 1.7 mm depths of cut. It is the latest product added to the company’s kitty in November 2019. Its strong main cutting edge ensures high levels of durability and process security, especially when machining corners inside a pocket. With eight cutting edges, the square-shaped SNGX11 also represents an extremely economical solution.

Dealing with market challenges

There are a number of technical, financial and operational challenges in the die and mould market. Sadly, there is not a common solution that would address everything, thus far. Die and mould manufacturing requires high-quality and high-precision equipment/tools/software/processes. Discussing the challenges, Seth feels, “Investment in capital goods remains the larger portion, followed by real estate. On the operational front, raw material, consumables and manpower demand a higher cash flow than what the market practically provides. Often because of the above, toolmakers tend to use the easier solution of using local tools, used machinery and pirated software. Not only does this compromise their output, but it also puts them at risk of losing a lot over the long run, vis-à-vis short-term marginal gains. Associations like TAGMA are now educating the broader toolmaking fraternity on industry best practices and are also enabling small toolmakers by providing access to common advanced facilities. I’m positive that today’s challenges will reduce drastically over the next decade or so.”

Currently, OEMs and tier-I companies import their critical tooling from other countries. There is a huge opportunity in the precision plastics business, which can be tapped if the bulk of our tool rooms upgrade their manufacturing ecosystem. A number of tool rooms also need to upgrade their infrastructure to benefit from the efficiency that the new systems bring.

Associations like TAGMA are now educating the broader toolmaking fraternity on industry best practices and are also enabling small toolmakers by providing access to common advanced facilities.

Vineet Seth, Managing Director – South Asia & Middle East, Mastercam APAC

Owing to industry’s varied nature, end users would require intense technical support and advice to acquire the right high-quality tooling.

Gautam K. Ahuja, Managing Director, Dormer PrametPvt. Ltd.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

English

English Hindi

Hindi