Healthy ‘money’ concerns of machine tool industry

March 7, 2019 6:01 pm

MSMEs contribute to employment and inclusive growth and credit flow to them is critical. Here is an industry analysis on what is going wrong on the ‘financial’ front and what needs to be done to strengthen the financial status of the machine tool industry.

The lending processes for SMEs and MSMEs have multiple pain points, unaddressed challenges and inefficiencies in the traditional and online world and are no different to the machine tool industry.

Finance challenges in machine tool industry

The financial institutions look at various factors to assess an MSME borrower, right from a healthy cash flow, steady growth, good credit bureau history, a maintained healthy accounting practice, supplier relationships to showcase stability, inventory management as per business cyclicity, which is not always available. Prateek Agarwal, Business Head-Lending, ftCash says, “There are so many requirements in terms of documentation that the MSME entrepreneur takes guidance and resorts to the intermediary or DSAs for securing him the finances from various banks and NBFCs.”

Majority of the unorganised small businesses do not go for formal credit due to lengthy paper work and documentation requirement in a brick mortar/traditional lending system. The others are denied credit due to unavailability or poor financial history, lack of collaterals and infrastructure, low ticket size of loan or a repayment track which most of FIs look at. Agarwal adds, “There is a need for a single window to help MSMEs and SMEs get access to funds.”

Only 42 per cent of the machine tool industry needs are met by domestic manufacturers, rest of the requirements are imported. But, to generate 100 million jobs and push the GDP contribution from manufacturing industry to 25 per cent, we require strong financing as the latter cannot be achieved on imported technology. Moreover, no country will share their advanced technology or latest innovations of aerospace and defense industry. But, for self-sufficiency, heavy financing is required.

Keerti Kumar Jain, Founder & CEO, Any Time Loan says, “While a positive wave came in when the budget 2019 was announced, raising the GST exemption limit to ` 40 lakhs and sanctioning of upto ` 1 Core loan for MSMEs under 50 minutes, the industry needs support in other forms for a better growth. Faster single window clearances, GST policies on land acquisition and ease of doing business will help Make in India a successful initiative. The government also should focus on a financial mechanism allowing Indian companies acquire firms abroad. Payments, taxation and procurement are the other challenges faced by the industry.

Some of the major players in this industry work on credit time which is a cycle difference for payment from the customer to the company and company to vendors. Generally, it is quite a good difference in tenure of these payment cycles. Maulik Patel, Executive Director, Sahajanand Laser Technology Ltd says, “To bridge the gaps in the payment cycles, companies have to look for previous financials or loans from the banks. These gaps are often unidentified and remain unattended by the union budget presented by the government.”

The 59-minute loan

MSMEs contribute to employment and inclusive growth and credit flow to them is critical. Often MSMEs face credit constraints and operate through self-funding. The 59-minute loan is expected to be a game-changer by easing the problems of the small enterprises in gaining access to funds. This will eventually pave way for the development of such units, improve the quality of their products, and smoothen their business operations. Machine tool industry will gain immensely

since SMEs significantly dot the country’s manufacturing landscape.

V. Anbu, Director General & CEO, IMTMA says, “The doubling of GST exemption is a welcome move by the government as it would mean small enterprises will have more capital at their disposal for meeting expenses.”

The Indian machine tools industry is highly fragmented with many small, medium and large suppliers who compete in product differentiation, service portfolio and pricing and businesses can be safely bifurcated among the GST, non- GST businesses and digital and non-digital businesses. Agarwal says, “The government initiative of lending market place – the 59 minute loan is a great online option for the businesses that have all required pre-requisites like GST details, ITR documents and online access to bank statements etc. and will gain acceptance over a period of time and is in direct competition with the new age fintech’s and market place who serve the similar customer segment.”

However, there is a large GST exempted population of businesses who do not have these pre-requisites but have much larger need for credit which still needs to be addressed. Simple but scalable and sustainable platforms like UPI needs to gain more penetration in the cash dominated businesses which can in turn be a surrogate for digital history and get into the formal credit league for financial institutions.

There can be certain benefits with this scheme but it is more profitable to micro and small industries. Patel says, “Medium enterprises like ours show continuous progress and lie in the top tier class of medium organisations which means we would require much larger capital in debt/loan to continue some of our functions. Yes, GST exemption, of course! But again, it may also be highly regarded for micro and small organisations.”

For India, to become a manufacturing hub, various strategic reformations are required and the hike in GST exemption limit is one among them to strive towards Make-in-India initiative. The hiked threshold will reduce the burden of compliance. Currently, the Indian machine tool industry comprises of 1,500 units dotted across the country.

Jain says, “Keeping the heavy investments required to build a self-sufficient machine tool industry, the centre sanctioned 59-minute loan up to ` 1 crore for GST registered MSMEs. The introduction of GST itself tended to shift India from agrarian economy to manufacturing economy.”

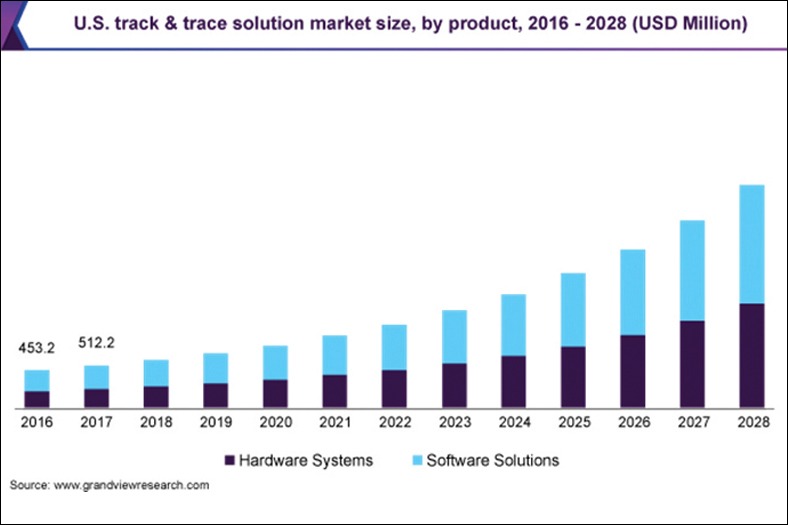

During 2017-18, the machine tools imports to India has reached 7752 crores, compared to 6173 crores during 2016-17, showing a Y/Y growth of 25.6 per cent. Meanwhile, the exports declined by -1.4 per cent. Hopefully, the twin move by the government will push the growth of the sector.

Redefining the lending paradigm to bridge the finance and transaction gaps

In the current formal lending process, the FIs (Financial Institutions) look at various parameters like lengthy paper work, financial history, collaterals, a health repayment track and high bureau scores of directors or proprietors for existing businesses and not many credit options for first generation entrepreneurs.

Agarwal says, “The future of lending to the SMEs in India needs to be redefined when there is a partnership between government bodies, regulators and FinTech’s who would need to create a tech-enabled platform focused on meeting the lending demand of the SMEs.” This partnership needs to enable in creating a trail of digital transactions using formal and alternative data points like online financials, credit bureau checks and social data.

Around 90 per cent of Indian machine tool sector comprises of SMEs and all of these need finance to expand their business horizons as well as keep pace with growth and development. Financial institutions and banks lend money to MSME sectors at varied interest rates.

Anbu says, “The industry feels that this needs to be lowered which will make it easy for the MSMEs to repay. In overseas, the interest rates for lending is lower as compared to India. However, government is extending all possible support to ease this and provide viable solutions for industries to gain access to capital from banks and financial institutions at better rates.”

Despite the contribution made by machine tool industry to the growth of the economy, it largely remains un-served by the financial institutions. The overall MSME industry has a huge unmet credit demand of about $ 200 billion. Jain says, “A renewed and polished approach will help the machine tool industry receive credit from fintech and traditional banking sector to bridge the gap and achieve full potential.”

Patel says, “Transaction gaps has been one of the key factors for slowing down growth in the sector. These transaction gaps result in difficulties to MSME sector for managing operational costs and thus disturbing current finance from the banks and eventually slowing the overall banking-interest process.”

Digital lending platform

A fully integrated ideal platform is possible when there is availability of online KYC validations like Aadhar, MCA, financial checks, credit bureau checks and alternative social data and intent match etc. which can be seamlessly validated through the API driven tech interface to assess the credit worthiness of a borrower. Some have even integrated geo tagging and psychometric tests to validate the physical presence and Intent of the borrower. These data points and alternative underwriting is helping a few players to bridge the gap and overcome the challenges of traditional lenders.

Agarwal says, “It is definitely not a simplified process for now but with various government initiatives, it would be safe to say that in a few years, the new-age digital lending platforms are coming to the rescue to ensure hassle-free loan disbursements for SMEs, where SMEs would also be expected to update their digital knowledge and presence.”

The growing demand of credit, availability of funds sets the stage for digital lending revolution. The untapped credit demands can be met with alternatives such as Peer-to-Peer lending, which offers unsecured loans to MSMEs. Jain says, “AnyTimeLoan.in is one such leading company, providing loans upto ` 10,00,000 in just a few seconds. This will help the existing machine tool firms to expand their businesses and serve credit to small firms, eliminating the cumbersome process when compared to traditional loans.”

FinTech’s who would need to create a tech-enabled platform focused on meeting the lending demand of the SMEs

Prateek Agarwal, Business Head-Lending, ftCash

The untapped credit demands can be met with Peer-to-Peer lending offering unsecured loans to MSMEs

Keerti Kumar Jain, Founder & CEO, Any Time Loan

Transaction gaps disturbs the current finance from the banks and slows the overall banking-interest process

Maulik Patel, Executive Director, Sahajanand Laser Technology Ltd.

The industry feels that the interest rates needs to be lowered to make it easy for the MSMEs to repay

V. Anbu, Director General & CEO, IMTMA

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

English

English Hindi

Hindi