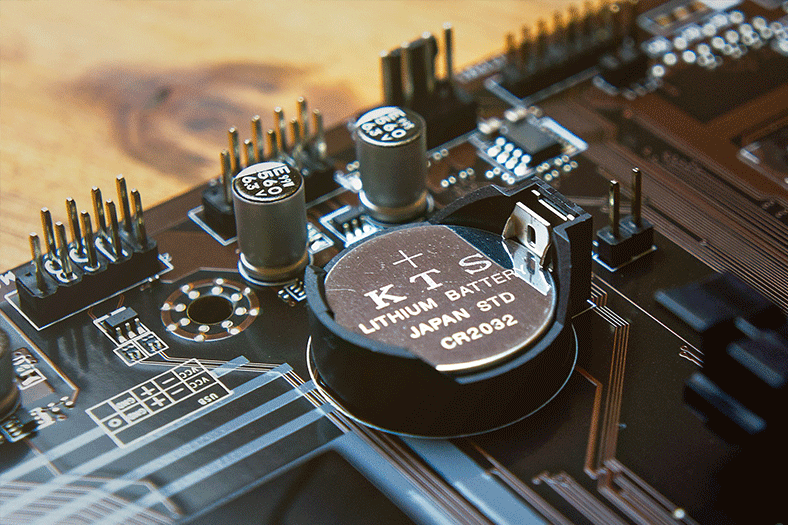

Energy storage capacities rising in India

May 7, 2020 4:54 pm

Demand for energy storage and management technologies is taking off due to factors such as development of smart cities, electric mobility, and energy access. We take a look at how companies in the sector are gearing to capitalise on this growth.

Energy storage and management technologies have huge potential to significantly contribute to the transformation of the Indian electric grid towards a greener, resilient, and reliable grid within the next decade. Advanced energy storage technologies can play an important role in renewable integration, energy access, electric mobility, and smart city initiatives by the Indian government. This article analyses the growth in the sector and the new capacity additions that are helping to improve efficiency and quality of energy storage technologies.

Growth of the energy storage and management sector in India

Suseendiran S R, Co-founder, Elicius Energy (incubated by Social Alpha, an entrepreneurship-focused ecosystem) says, “The growth drivers of the energy storage and management sector in India are innovative manufacturing processes and devices to reduce the capital expenditure and making the technology accessible to a wider sector.”

The demand for energy storage in behind-the-meter applications will account for 68-77 percent of the cumulative market during 2020-2027. Inverters and telecom will take the major share of the BTM market.

Recently, the India Energy Storage Alliance (IESA) predicted that India has the potential to deploy over 300 GWH of energy storage by 2022. With respect to this, Debi Prasad Dash, Executive Director, India Energy Storage Alliance (IESA) informed us, “In 2019, Tata Power, AES, and Mitsubishi Corporation inaugurated India’s first grid-scale battery-based 10 MW energy storage system at Tata Power Delhi Distribution’s Rohini Substation, to provide better peak load management, system flexibility, and reliability to more than two million consumers. There are more than 17 MWh large-scale advanced energy storage projects installed in India. Applications like solar storage, energy storage for telecom infrastructure, data centre, and diesel usage optimisation will drive the growth of energy storage in India.”

He added, “Already, over 1 GWh of annual assembling capacity is being set up for converting imported Li-ion cells into battery modules by various Indian and global companies in India. This includes IESA member companies like EXICOM, ACME, Okaya, Future Hitech Battery, Pastiche Energy, Green Fuel Energy, Vision Mechatronics and others. Opportunities include manufacturing, assembling, equipment and raw materials supply, R&D of technology enhancement and much more.”

IESA also predicted that the domestic energy storage market will grow at a CAGR of 6.1 percent by 2026. In light of this report, Suseendiran told us, “The market report published by IESA clearly outlines the different area in which the growth will happen. For example, the inverters segment is expected to witness the largest growth. The number of start-ups targeting to bring renewable energy to the inverters market is very low. So, the start-ups can find lot of opportunity from that report and develop innovative products based on the analysis.”

Proper framework, infrastructure and technological improvements needed

Dash said, “The central and state governments do not have appropriate policy for large-scale energy storage adoption with renewable and grid stability. A framework to support energy storage for ancillary services for the electricity grid is long pending. Unlike the solar and telecom industries, the government should provide appropriate incentives and create manufacturing clusters to support MSMEs to create component manufacturing. Supply chain is also a bottleneck for energy storage manufacturing. Bilateral agreements with cobalt and lithium rich countries and policy for urban mining need to be in place for the industry’s long-term growth.”

Suseendiran said, “The major disadvantage of renewable energy sources like solar and wind is its intermittent nature. One way to store this energy is to store it in the form of hydrogen by splitting water. The hydrogen can then be used in a fuel cell to produce electricity. Elicius Energy is working towards the development of these fuel cells. Development of fuel cells is a capital-intensive process and bootstrapping is very much impossible. So, one of the biggest challenges for our company is to convince investors to invest in the company. The other challenge will be to set up the hydrogen infrastructure which doesn’t exist in our country.”

Government initiatives to boost energy storage technologies

The National Mission on Transformative Mobility and Battery Storage is driving companies in the sector to innovate and grow. According to Suseendiran, “Even though the progress towards adaptation of renewable energy is very great in India, the number of industries focusing on manufacturing of energy storage devices is very low. The National Mission on Transformative Mobility and Battery Storage will enable more start-ups and industries to focus on the manufacturing of energy storage devices and their components.”

Dash stated, “Electric vehicle (EV) manufacturers have chosen Li-ion as one of the preferred technologies due to higher energy and power density. At the same time, India has also seen large-scale utilisation of lead acid batteries for e-rickshaws. One of the challenges for EVs in India is the higher temperatures and thus, there is a focus for research on batteries with higher temperature tolerance as well.”

Li-ion battery accounts for 40-50 percent of the overall cost of EVs and is the most expensive component of EVs. Indigenous manufacturing will bring down the cost of Li-ion batteries and thereby the cost of EVs. All the foremost OEMs are currently importing batteries from China, Taiwan, and Korea. Various Indian companies have already entered into cell-to-pack assembling. But there is a huge opportunity in India for Li-ion cell manufacturing India. Through the Make in India initiative, India will able to compete with countries like China, Australia, Germany, the US, Taiwan, South Korea and other manufacturing countries.

Dash commented, “NITI Aayog is working on creating the framework for incentivising large-scale advanced energy storage manufacturing in India and setting up of Giga factories in India. Under the FAME II policy, the central government is also increasing the custom duty for various components and providing incentives for indigenous manufactured components for electric vehicles.”

Research and development set to give domestic market a greater push

With regards to R&D in the energy storage and management space, Dash told us, “Energy storage policy changes took a decade-long effort in developing countries such as the US, Korea, and Europe. In India, over the past eight years, we at IESA worked diligently to create awareness about energy storage technologies, business models, and policies. We have also done initiatives to create industry capabilities and help IESA members to develop business. IESA works closely with national labs like CMET, NRDC, and Department of Science and Technology (DST) on energy storage research, prototype development, and lab to commercialisation effort. IESA is also working with global players and Indian conglomerates on alternate technologies like metal air, sodium-based batteries, and ultra-capacitors for technology transfer and manufacturing. IESA is playing a key role in promoting India as a destination for R&D collaboration and manufacturing. Our R&D initiative is industry-focused, and we are helping clients to solve the challenges that they are facing while deploying storage solutions for any application be it stationary, EV or others.”

Vishal Singhal, Co-founder, Temperate Technologies (incubated by Social Alpha), shared, “Temperate Technologies is working on thermal energy storage for air conditioning. This involves generating ice when electricity is abundant, e.g., in the early morning hours, and using that ice for air conditioning during peak power demand hours. As demand for air conditioning is increasing rapidly in our country, it is estimated (https://www.iea.org/reports/the-future-of-cooling) that by 2050, 45 percent of peak power consumption on the national grid would be due to air conditioning. Thermal energy storage can help in time-shifting the air conditioning load. This can reduce energy costs and CO2 emissions. Our R&D in the field is focused on increasing the end-to-end system efficiency of the storage operation and decreasing the upfront cost of the system.”

Suseendiran stated, “We are developing tubular proton exchange membrane fuel cells which possess higher gravimetric and volumetric power density compared to the existing planar PEM fuel cells. We are also focusing on reducing the cost of the fuel cells by developing cheaper materials and also by improving the performance of the existing materials.”

These ongoing research and development efforts as well as the various initiatives taken by the government will push the energy storage and management market in the country. It will also increase efficiencies in different industries and sectors such as electric mobility, renewable energy, etc. and in turn make India a global leader in this space.

Suseendiran S R, Co-founder, Elicius Energy

Even though the progress towards adaptation of renewable energy is very great in India, the number of industries focusing on manufacturing of energy storage devices is very low.

Debi Prasad Dash, Executive Director, India Energy Storage Alliance (IESA)

NITI Aayog is working on creating the framework for incentivising large-scale advanced energy storage manufacturing in India and setting up of Giga factories in India.

Vishal Singhal, Co-founder, Temperate Technologies

Our R&D in the field is focused on increasing the end-to-end system efficiency of the storage operation and decreasing the upfront cost of the system.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

English

English Hindi

Hindi