Nurturing the die & mould industry with technology

April 13, 2019 12:46 pm

Industry experts talk about the changes taking place in the die and mould industry, in order to meet growing customer demand without compromising on quality of the product.

With rising demand, die and mould industry is witnessing gradual changes in terms of adopting new technologies to boost production and efficiency. Die and mould industry is growing aggressively in India.

Scaling manufacturing obstacles with technology

Moulds and dies are required for various purposes, from household items to automotive. However, manufacturing challenges are also growing up, as the designs are getting more complicated.

Mayank Tripathi, Area Manager Sales North India, Hurco India, says, “Hurco has been bundling its decades of experience in die- and mould-making with a forward-looking product portfolio and the design of individual manufacturing solutions, achieving the desired results on time.”

According to Tripathi, the major obstacles for die and mould industry are follows:

• Consumer demand: Consumers’ rising power and unmet needs around personalisation, customisation and co-creation are causing niche markets to proliferate.

• Products: Technological advances enabling modularity and connectivity are transforming products from inert objects into “smart” devices, while advancements in materials science are enabling the creation of far more intricate, capable, and advanced objects, smart or otherwise. At the same time, the nature of the product is changing, with many products transcending their roles as material possessions that people own to become services to which they buy access.

• Economics of production: Technologies such as additive manufacturing is making it possible to cost-effectively manufacture products more quickly, in smaller and smaller batches.

“Hurco has got an integrated machine portfolio for individual processing solutions in the automobile industry and consumer goods. Our Winmax control is helping customers in achieving on-time production by reducing non cut time,” he adds.

Vineet Seth, Managing Director – South Asia & Middle East, Mastercam APAC says, “Technology has been leading the die and mould industry further and further each year. Demand is ever increasing. I see a lot of tool-making companies investing in complex multi-tasking machines in the recent times. They are also investing in water-tight processes and are expanding their manufacturing operations and horizons.”

“This will allow the industry to showcase capability and as a result move a greater chunk from our tooling imports portfolio into the domestic manufacturing sector,” he adds.

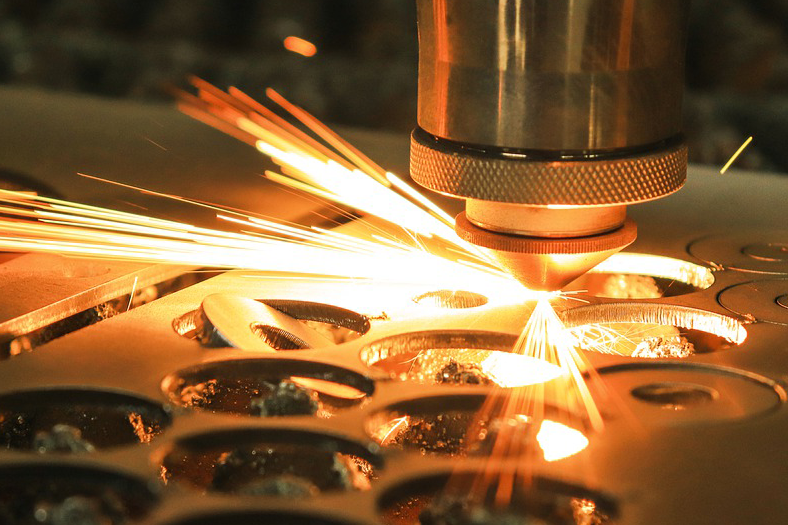

According to Mayank Patel, R&D Head, SLTL Group, the industry is going through some minor, but important shift to adopt new technology to reduce the processing time.

“With the introduction to several technologies like SLTL Group’s laser systems are making die marking faster and with advanced laser cleaning, which is used for industrial die cleaning (rust removal, degreasing). Along with laser marking and cleaning, laser welding is also used in industry for its capability to provide superior strength and finish,” he adds.Furthermore, the industry is very inclined to automate their manufacturing process for more productivity and precision purposes.

Challenges in die and mould industry

The die- and mould-making industry in India has developed over the years and vies today on a worldwide platform. Plus, the manufacturing practices of the tool room industry are also experiencing a drastic change.

According to Tripathi, the lead time and quality meeting global standards are major issues faced by the local die and mould making industry. The reasons are on-time availability of raw material;majority of the die steel used in die- and mould-making is imported;machine and inspection equipment’s availability is limited up to big tool rooms only in India; andsmall andmedium tool rooms are not able afford to because of the cost involved.

However, Vineet Seth explains that there are quite a number of challenges that afflict our domestic die and mould industry. “One of the major challenges is the huge amount of imports in dies and moulds into the country, which we can largely attribute to global competition and the ease of access. The other major challenge is that the industry is capital-intensive, which means that a lot of toolrooms need to invest in machine tools, metrology equipment, stock material and CAD/CAM/CAE tools, in order to be competent and competitive,” he says.

For the former, OEMs in India should start nurturing toolrooms by working alongside with them and building an ecosystem that is both, sustainable as well as competent. In the latter, steps are already being taken across different levels; toolroom clusters are coming up at various locations in the country, it is now easier than before to get financing from financial institutions, many international players in the technology market are now offering reasonable and subsidised pricing.

“As far as skilled manpower is concerned, in my opinion, Indian toolrooms are pretty safe in the knowledge that young talent is easily available and affordable. Organisations like TAGMA and IMTMA are offering numerous training programmes for working engineers and technicians and I’m positive that this will allow our toolrooms to grow organically through the knowledge garnered through these programmes,” Seth adds.

However, Mayank Patel is of the opinion that in India, die and mould industry is still heavily dependent on unskilled labour. “That is one of the reasons why India is able to keep prices of the product down to grounds. On the other hand, the industry is struggling to keep up with the pace of technology and skilled manpower of overseas industries.”

Pro-market government policies

The die and mould industry of the country has undergone an inspiring transformation, says Tripathi. “It’s now capable of catering to a variety of specific demands from a number of booming sectors including automotive, plastic, electronics and electrical, healthcare, and machine tools. Government’s focus on ‘Make in India’ campaign and emphasis is being given to the emerging areas like aerospace, defence, power, railways and heavy engineering has given a new lease of life to the tooling sector. Sources say country’s passenger vehicle market is expected to expand by 10 per cent and is set to overtake the requirement of many European countries, this year, in terms of volume for the first time. The demand for die and mould will increase to support the growing automotive sector in both the passenger car and two-wheeler segments.

Automobile is the largest customer of the die and mould, followed by the white goods. These sectors have promising future. “The market is positive and the tooling industry is expected to grow more.“Govt. is also helping industry to start cluster (common facility) where SMEs and MSMEs can have the latest machinery schemes like credit link. Subsidies are also helping the MSME and SME tool shop, says Tripathi.”

The Make in India initiative, 100 per cent FDI in tooling industry, smart cities initiative, cluster development programme, priority sector lending, QMS/EMS fee reimbursement scheme, export promotion are amongst the few policies that actually make a difference to this industry. Seth says, “Tool rooms must make use of all of these benefits and progress towards a technologically developed as well as economically propulsive future.”

Die and mold industry is booming and we can see subsequent market growth in recent years. The reason for the growth is industry’s capability to compete in global market and pro-market government policies. Patel says, “Nearly 50 per cent of the supply comes from small and medium tool industry. Also, with introduction to new MSME policies by the government will pave the way for healthy growth. This would be a crucial step to see more Indian industry in the global market.”

Consumers’ rising power and unmet needs around personalisation, customisation and co-creation are causing niche markets to proliferate

Mayank Tripathi, Area Manager Sales North India, Hurco India

OEMs in India should start nurturing toolrooms by working alongside with them and building an ecosystem that is both, sustainable as well as competent

Vineet Seth, Managing Director – South Asia & Middle East, Mastercam APAC

Die and mould industry is very heavily dependent on unskilled labour; one of the reasons why India is able to keep prices of the product down to the grounds.

Mayank Patel, R&D Head, SLTL Group

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

English

English Hindi

Hindi