Heavy equipment Slow but Steady

December 16, 2019 11:42 am

Discussing about the developmental factors in the infrastructure equipment industry, leaders mention how like redoubling investment can be key strategy to counter the impacts of a downturn as empirical evidence indicates that public investments precede any pickup in economic activity.

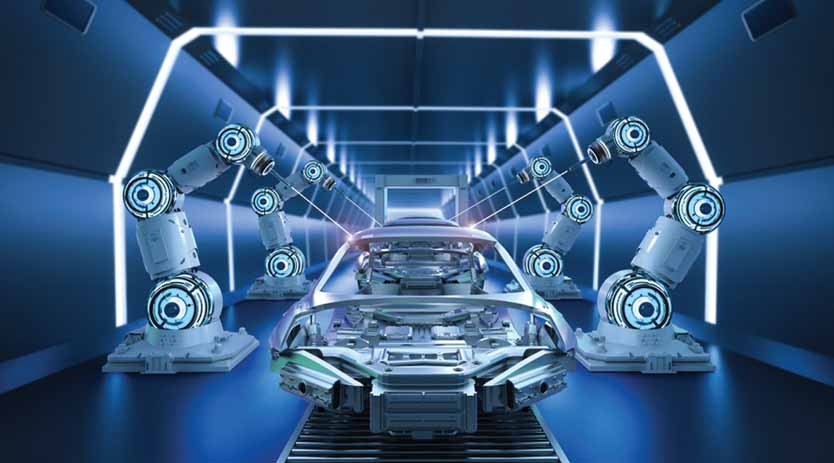

Indian manufacturing has been witnessing a slight boom even after there were reports of slowdown being faced by parts of the industry. Industrial challenges including infrastructural unavailability, complex taxing systems, conservations in the supply chain industry and agile manufacturing being a few of the mentions; has casted India amongst the countries with manufacturing attractions. Moreover, government’s ‘Make in India’ initiative has been incentivising copious manufacturing companies to carve a conducive environment to boost the manufacturing sector.

Incontestable challenges in infrastructure industry

A significant financial outlay announced by the government in the recent union budget is a major move in bringing the much needed boost to the infrastructural equipment industry. This will boost demand for road equipment. Noting the impending demand for infrastructural development, Manish Arora, Business Head, Construction Equipment Div, Mahindra & Mahindra Ltd. Feels that there is still so much work to be done in India, especially in the Infrastructure sector. If we consider reaching the core issue, Arora says “Most of the small scale and unorganised industry still relies on labour or uses outdated equipment. There is a huge potential there if we can understand the needs of the customer. Secondly, if you look at developed countries, US, Canada, UK, Germany etc. the infrastructure there is far more advanced, in terms of both reach and quality, and we are still playing catch-up.” Be it in terms of improving the current road network, expanding the network, building smart cities, airports, and several mega-projects; the future of CE is definitely bright in India.

Whereas, R Haridoss, Vice President Business Development, Power Build Pvt Ltd highlights that Indian construction equipment market has been on a major upswing since 2015 with the sales of construction equipment growing by 24 per cent and in FY17-19 crossing the 90,000 unit sales. “Our current government’s focus is on infrastructure development make in India to become of the fastest infrastructure developing countries in the world. The budget allocations for FY 2019-20 indicated towards a continued growth momentum which focuses roads, railways, aviation and waterways. At the moment the industry is going with a slow pace but I am sure that it will bounce back very soon” he added.

Significant growth conversion

Roads and Highways will be a key growth driver for the Construction Equipment Industry and critical to fulfilling the $5 trillion economy dream of India. It focuses on rural economy as the major contributor in the foreseeable future, with rural roads development projects being in the forefront. According to Jasmeet Singh, AVP, Corporate Communications & Corporate Relations, JCB India Ltd, with implementation of large-scale projects, including projects of national importance, the road equipment industry is on a path to gain momentum. Further, new growth drivers such as interlinking of canals, railways, mining, and real estate are going to push the sales and utilisation of road equipment. He says, “The Indian Construction Equipment industry is also fully embracing the convergence of digital and traditional technologies with JCB India, a leading manufacturer of Earthmoving and Construction Equipment pioneering the way.”

On the other hand Devendra Kumar Vyas, MD, Srei Equipment Finance Ltd says that the domestic sales of construction equipment have fallen by around 17-20 per cent in the first half of this fiscal. “The impact is much more severe when it comes to construction equipment financing, whose disbursements are further down in the same period as it was doubly impacted by the slowdown as well as the credit crisis. I believe that once the stimulus measures by the government to revive domestic investments kick in, the effect will be immediately felt in the construction equipment segment” he adds.

Rejuvenating the ailing market

Slowing private consumption, weak consumer demand, and a flagging global environment are the key factors behind the slowdown being currently faced by the core Indian sectors. The impact is faced across all Industries including auto, manufacturing, construction, real estate and FMCG. The use of construction pervades various such industries, and is thus impacted by not only by the policies aimed specifically at infrastructure, or construction equipment, but also by the policies in the other segment.

The Indian Construction Equipment market has been on a major upswing since 2015. Dimitrov Krishnan Vice President and Head of Volvo CE India say that they peaked in terms of both sales and demand in 2018. He says “This year, however, we experienced a slowdown but now we see signs of revival. 2020 certainly looks promising given the government’s recent policy pronouncements such as corporate tax breaks and renewed thrust on massive infrastructure development. We expect the industry to log compounded annual growth of 8-10 per cent over the next five years. Volvo CE India is poised to grow, on par with industry, if not better.

R Haridoss, Vice President Business Development, Power Build Pvt Ltd India has still lot of improvement scope in basic infrastructure facilities apart from the aspiration infrastructure development like smart cities and bullet train. We expect government to come up schemes on rail, road, bridges and housing etc. The government must also see that circulation of money does not stop, there has to be some relaxation in taxes to promote sales of manufacturer of construction equipment and similarly relaxation for the users. Recent announcement by the Government of India for domestic infrastructure and corridor development will certainly help this segment to grow.

Worldwide, redoubling of investment in infrastructure is a key strategy to counter the impacts of a downturn as empirical evidence indicates that public investments precede any pickup in economic activity. Devendra Kumar Vyas, MD, Srei Equipment Finance Ltd talks about their customised schemes and says “We have tied up with leading global equipment manufacturers and are coming up with a lot of exciting schemes with customised financing solutions covering the entire asset life-cycle to our customers. The government has taken several measures to revive the private sectors including a massive cut in corporate taxes, a ₹25,000 crore fund to boost realty sector, and capital infusion into public sector banks. I believe, these measures will go a long way in improving the sentiments of these industries, and it is just a matter of time for investments to materialize in the private sectors.

Way forward for an integrated OEM

Customer preferences are ever evolving. Revolutionary trends appear to be emerging in the equipment financing sector. Dealers and OEMs are expected to offer customers integrated choice, which will include the equipment finance (and could also cover the lifecycle financing of the equipment). Currently, there are a few companies which provide a platform for equipment owners and customers to interact and avail of equipment services. This could be a good opportunity for finance companies to participate and ensure that all finance needs are met. Customer’s demand for greater flexibility and convenience will augment the use of nonstandard financing agreements. Shifts in customer preference for managed services (bundling equipment, services, supplies and software), pay-per-use leases and alternative financing will encourage equipment finance companies to find innovative ways to meet the demand.

Road equipment industry is gaining momentum with the implementation of large-scale projects, national projects.

Jasmeet Singh, AVP, Corporate Communications & Corporate Relations, JCB India Ltd

Considering the developments in road network, smart cities, and other projects; the future of CE is definitely bright in India.

Manish Arora, Business Head, Construction Equipment Division, Mahindra & Mahindra Ltd

Once the government’s initiatives to revive domestic investments kicks in, the effect will be immediately felt in the construction equipment segment.

Devendra Kumar Vyas, MD, Srei Equipment Finance Ltd.

“With policies like corporate tax breaks and renewed thrust on infrastructure development, 2020 looks more promising.

Dimitrov Krishnan Vice President and Head of Volvo CE India

The government should ensure that investment stays in, along with some relaxation in taxes to promote sales of manufacturer of construction equipment.

R Haridoss, Vice President Business Development, Power Build Pvt Ltd

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.