Digitale India

June 30, 2017 4:32 pm

Experts unravel India’s digitisation journey in the field of industrial manufacturing

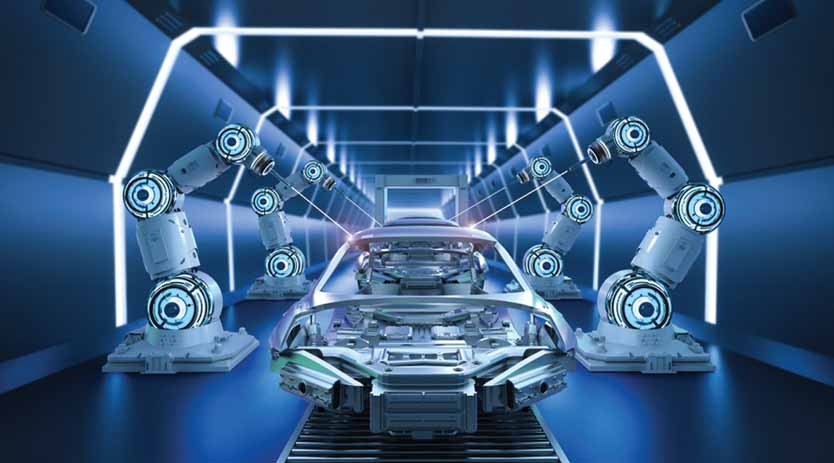

Introduced by Germany, Industry 4.0 or the fourth industrial revolution concepts are in harmony with worldwide initiatives, including Smart Factories, Industrial Internet of Things (IoT), Smart Manufacturing, and Advanced Manufacturing. This revolution in manufacturing landscape is changing continuously across boundaries for greater efficiency.

Manufacturing industry in its early days may have been slow to the advent of digital technologies but of late this has gathered steam with the realisation of the impact of digitisation across the manufacturing value chain. According to P.G. Jadeja, President, Indian Machine Tool Manufacturers’ Association (IMTMA), “Digitisation hauls up internal processes, enhances efficiencies, attracts employees and improves the overall profitability of the industry.”

Marc Jarrault, Managing Director, Lapp India, said, “Industry 4.0 is all set to become a reality in India soon, transforming radically the way industries work and do business today.”

Manufacturing companies in India are working in tandem with the ‘Make in India’ initiative that aims to make India a manufacturing hub for business across sectors. The idea is to promote manufacturing technologies, machines and products that will drive the change not only for businesses but for end users as well. For an emerging economy like India, Anand Prakasam, Country Manager, EOS India believes, it is imperative for the industrial products sector to leverage technological breakthroughs for building the digital ecosystem. This is going to help organisations gauge customers’ needs and requirements and accordingly add significant value to their offerings along with driving efficiency improvements across the value chain, he adds.

Though digitising of production recipes, processes and systems will ensure suppliers will move to the next level in terms of operating efficiency, and transparency, TK Ramesh, CEO of Micromatic Machine Tools believes, for an end-user to benefit rapidly, it will be in their best interest to deploy frameworks available from mature players in the industry, which offer domain-rich adaptability, and solutions for specific use-cases, in the context of a larger roadmap.

Digitisation is no longer an option, but a necessity

Digitisation drives cost advantages, enhanced customer experience, reduced time-to-market, and improved productivity for almost every phase of product lifecycle including R&D, supply chain management, marketing, sales, and customer service among others. Digital technologies enable plants to track every asset on the shopfloor as well the goods in transit on a real-time basis using embedded sensors. The resulting data is collected and used for diagnostics, preventive maintenance, asset maintenance, customer usage pattern study, consumable management, and workflow management. According to a report by global consulting firm PricewaterhouseCoopers (PwC), almost two-third of Indian manufacturing firms expects to use digital technologies by 2020.

Today progressive manufacturers recognise that digitisation is no longer an option but a necessity to achieve efficiency and profitability. However, in India, the industry is yet to harness all the advantages of digital transformation. “Manufacturing companies must derive clear vision on the digital strategy from the leadership, build skills in data analytics and overcome operational disruption from cyber security breaches among others,” suggests Sangram Kadam, AVP and Head – Oracle and Manufacturing IBU (India and South Asia), KPIT Technologies.

Increased connectivity in the manufacturing environment and the creation of a digital ecosystem that will drive productivity, operational efficiencies and lower costs have become crucial in driving digital transformation across three important areas including digitisation and integration of vertical and horizontal value chains; digitisation of product and service offerings; and digital business models and customer access.

Almost 70 per cent of Indian automobile sales or $40 billion is likely to be digitally influenced by the 2020, as compared with $18 billion today, a recent report by Bain & Co. and Facebook Inc. said.

The report, which dwells on the impact of digital technologies in the automotive industry, said digital engineering, 3D printing, smart sensors and the IoT will disrupt auto R&D, manufacturing, sales, marketing and after-sales services.

No more a low cost hub

PV Sivaram, Managing Director, B&R Industrial Automation is of the opinion that today manufacturing not only looks at productivity in terms of quantity and quality but also in terms of OEE, energy monitoring, condition monitoring and machine and plant availability. He further observes, “Technology transition times from the developed economies have shortened. India no longer wishes to project itself as a low cost hub, rather wants to be best-of-class and preferred choice.”

Smart factories: A global snapshot

Smart factories would add $500 billion to the global economy by 2022, said Capgemini. According to a research from the agency’s Digital Transformation Institute, manufacturers expect that their investments in smart factories will drive a 27 per cent increase in manufacturing efficiency over the next five years which would add $500 billion in annual added value to the global economy.

Often described as a building block of the ‘Digital Industrial Revolution’, a smart factory makes use of digital technologies including the Internet of Things, Big Data Analytics, Artificial Intelligence and Advanced Robotics to increase productivity, quality and flexibility. Smart factory features include collaborative robots, workers using augmented reality components and machines that send alerts when they need maintenance.

“By the end of 2022, manufacturers expect that 21 per cent of their plants will be smart factories. Sectors, such as aerospace and defence, industrial manufacturing and automotive, where people are working alongside intelligent machines, are expected to be the leaders of this transition,” Capgemini’s report revealed.

A few points to consider

Digitisation can be a game changer for Indian manufacturing owing to the immense possibilities it has in store. Many of the Indian manufacturing companies have not yet invested extensively in the traditional automation, so digitisation is a far cry for them. However, Sameer Gandhi, Managing Director, OMRON Automation (India) feels, these manufacturers can now actually leapfrog the automation investment phase by adopting digitalisation and other smart factory technologies.

Though there is no dearth of enthusiasm within the Indian industry regarding IIoT or Industry 4.0, a majority of Indian industries especially local manufacturers and SMEs need to view and understand the core of this technology concept and attempt to increase efficiencies of their manufacturing activities plants and businesses, points out Ajey Phatak, Marketing Manager, Beckhoff Automation. He advocates, “There is urgent need for top- and middle-level management to consider and focus on digitising their products, processes and manufacturing technology aggressively.”

Raj Singh Rathee, Managing Director, KUKA Robotics India made a serious observation. He said that the small- and medium-scale are not yet ready to embrace digitisation as the industry lacks basic infrastructure like power supply. “Any interruption in the power supply results in complete halt of production line operations with even the best machines in use. Unless we have stable, clean and reliable electrical supply, it is not going to be easy for the companies to reap the benefits of digitisation,” he opines.

Conclusion

Today a lot of Indian manufacturing companies are largely domestic market-focused and are spread across many undifferentiated business models. According to Arun Rao, Director, Geo Strategic Operations & Alliances, Dassault Systemes – India, “Most of India’s largest manufacturers cannot return their cost of capital turning into a cause of dampening investment and making it less attractive than its counterparts in competing economies, such as China and Thailand. Keeping their aspiration to go global in perspective, Indian companies need to upgrade their operations, develop skill set and a keen look at the learning of the companies set in a global ecosystem.”

Working on digitisation for a manufacturing is an investment and will surely yield higher production, lower downtimes in future. “To witness any change we need to educate people first and the same goes for advanced concepts like digitisation and Industry 4.0. If the benefits and advantages of this concept reach to people, we will surely be successful to implement it in India,” concludes Sanjay Kulkarni, Managing Director, Pilz India.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.