Incentivising policies for automotive sustenance

June 18, 2019 11:45 am

The rapidly globalising world has opened newer avenues for the transportation industry, especially the transition towards electric, electronic and hybrid cars, says Rajnikant Behera, Executive Director, RSB Transmissions (I) Ltd.

Refuelling India’s automotive sector

The commendable Make in India initiative has fostered the growth of Indian industries in general and auto industry, in particular, due to the facilitative measures taken by the government for industrial sector, creation of conductive environment for manufacturing, pro-active policies/procedures and significant improvement in elimination of bottlenecks.

Make in India initiative has bolstered auto-comp growth with ease-of-doing-business (EDB) approach during the last five years. The FAME–India Scheme has led to a continuous increase in registered OEMs and vehicle models. The boost for refuelling growth, taming price pressures, facilitating industrial and business environment and simplifying the policies and procedures have given way to opportunities hitherto untapped.

Synchronising west with east through i-ways, fostering of innovation, incentivising investments, protection of intellectual property and building best-in-class manufacturing infrastructure, are positives that made Indian manufacturers to bolster industrial growth. Renewed thrust given to e-mobility in public transport, has seen number of e-vehicles plying on the road, reducing dependence on fossil fuels.

Realigning the priorities of Make in India for the automotive market

Reboot and alignment factors should be focused on providing access to modern technology and services in terms of cost, needs to be addressed to make us a significant global player. Conspicuous gap in energy needs v/s generation has to be evened out swiftly. High cost of power continues to be a hindrance to the competitive edge in the global market. Unless energy infrastructure is boosted with high capacity national transmission grid, the energy cost for majority of the Indian players will continue to be unaffordable.

The rapidly globalising world has opened newer avenues for the transportation industry, especially the transition towards electric, electronic and hybrid cars, which are more efficient, safe, reliable and green modes of transportation. The next decade, will lead us to the newer verticals and opportunities for auto-component manufacturers, who need to adapt to the change via systematic research and development. This transitional phase need to be addressed by incentivising the policies for sustenance of transitional phase of existing auto-comp industry.

Optimise gearbox efficiency

Power loss in a gearbox is attributed mainly to friction, resulting in heat generation. While heat generation is not an issue with smaller gearboxes as it is minimal, within the tolerance limit; in case of larger ones, it is more. This is compensated by use of oil coolers and pumps to keep the efficiency at a stipulated level.

Efficiency also depends on the quality of gearing, the number of tooth engagements and the torque load to reduce frictional heat. Overall system efficiencies depend on the efficiency of the motor and gearbox together. At low ratios, motors are more heavily loaded than the gearboxes. At higher gearbox ratios, motor and gearbox efficiencies follow similar pattern as the gearbox sees more of the load than does the motor. This leads to peak efficiencies in both gearbox and motor. To use the least amount of power and obtain gearbox efficiency at it speak, it’s critical to match the motor, gearbox, and the load closely to get the best system efficiencies.

Penetration of energy efficient motors remains low

Performance of motors in India are, by and large, affected by the quality of input power from public utilities, that is the actual volt and frequency available at motor terminals vis-à-vis rated values as well as voltage/frequency variations and voltage imbalance. Motors, in India, need to comply with higher in-built tolerance limits to take care of larger fluctuations of input power in public utilities in India.

Penetration of energy efficient motors is also low in India due to poor maintenance (inadequate lubrication of bearings, insufficient cleaning of air cooling passages, etc.) leading to deterioration in motor efficiency over time. Making any product in India takes 30-60 per cent more energy than in countries where manufacturing has achieved high levels of energy efficiency. Now spotlight is turning onto need for energy efficient motors. In India, motors typically consume around 40 per cent of energy produced. Going in for technology up-gradation for energy-efficient motor will have low carbon footprints.

Bharat Stage VI (BS VI) emission norms

With regulatory requirements coming into force to take care of the climate mitigation, industry will have to take up the challenge of aligning the facilities through adoption of appropriate technology, to be in tune with BS VI norms. It’s a move that would bring energy savings and increased international acceptance of our products. Already investment on up-gradation of facilities has been initiated by many leading auto-component players. This will carve a niche in the global market for Indian products, as it will be more environment-friendly with low carbon footprints. Industry can look forward to boost its exports and brim up foreign exchange reserves.

Customisations and technological advancements

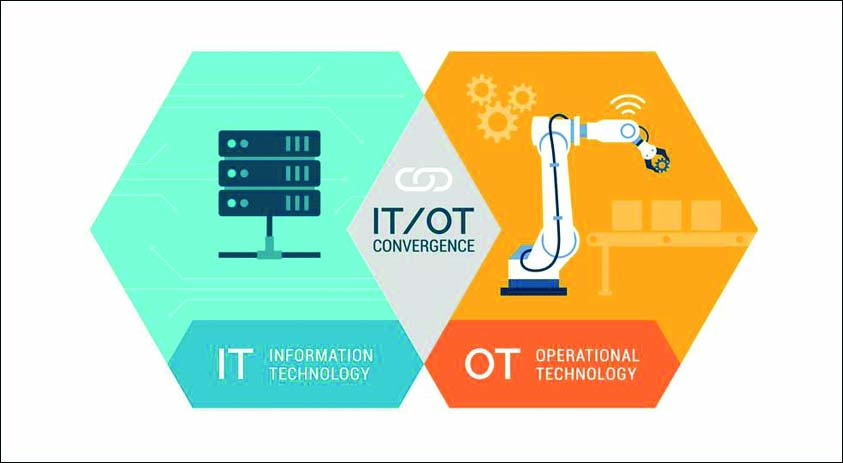

The explosion in data and new computing capabilities, along with advances in other areas such as Artificial Intelligence, automation and robotics, additive technology and human machine interaction, are unleashing innovation in the Indian automotive market. E-manufacturing in India has taken increased usage of IT solutions as enterprise resource planning (ERP) and manufacturing execution systems (MES) in order to enhance their productivity.

Achieving sustainability targets

The automotive industry, globally, has now started getting the feel of disruptive technologies and emergent changes in mobility. While digitisation, increasing automation, and new business models have revolutionised other industries, the automotive industry has no exception to such a revolution.

To sustain, Indian auto-comp industry will make in-roads in e-mobility through technological upgradation/set-up in line with OEMs requirement and simultaneously, target after-sales auto-comp replacement market for traditional IC segment post e-mobility for at-least a decade until total redundancy sets in, while putting a strong foot in e-comp market.

The existing IC vehicle owners, by rough estimates, will continue to use the conventional mobility for next 15 years, with fuel prices spiraling down due to onslaught of e-vehicle. While conventional IC replacement market will continue to last until it reaches redundancy through efflux of time.

Making any product in India, takes 30-60 per cent more energy than in countries where manufacturing has achieved high levels of energy efficiency

Rajnikant Behera, Executive Director, RSB Transmissions (I) Ltd

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

English

English Hindi

Hindi