Financing MSMEs

March 13, 2018 4:44 pm

An in-depth analysis on the status of MSME financing and the challenges faced. Finance companies also explain their commitments to the MSMEs.

One of the main challenges faced by MSMEs is lack of quick and easy access to finance as even after having so many financial institutions in the country more than 80 per cent MSME entrepreneurs have to resort to other avenues of financing. Second big challenge is the cash flow mismanagement which arises due to unforeseen expenses, regulatory changes, high debtors etc. Big companies are able to manage these issues as they have huge capitals but these MSMEs are not able to survive if their cash flow is upset for a long time. Presenting a report on challenges faced by MSMEs and the commitments made by banks and financing agencies for MSMEs.

Big relief for MSME sector

In the budget 18-19 the Finance Ministry allocated a total of Rs 3,794 crore for Medium, Small and Micro Enterprises (MSME) sector towards credit support, capital and interest subsidy as well as to spur innovation. They also announced measure to address the issue of nonperforming assets among the SMEs in India. Sanjeev Goel, Managing Director, Intec Capital Ltd says, “This will be a big relief for the MSME sector as this will allow the companies to resolve the cash flow problems solved by them and move on the journey of growth.”

He adds, “The reduction of tax rate to 25 per cent to companies which had reported turnover up to Rs 250 crore during the financial year 2016-17 will also hugely benefit the entire MSME sector, which accounts for almost 99 per cent of companies filing their tax returns. Finance Ministry also mentioned the revamping of the online loan sanction facility for MSME to ensure prompt decision making by banks. Overall this budget was in favour of the MSME sector which is the backbone of the Indian economy.”

Meeting financial requirements of SMEs

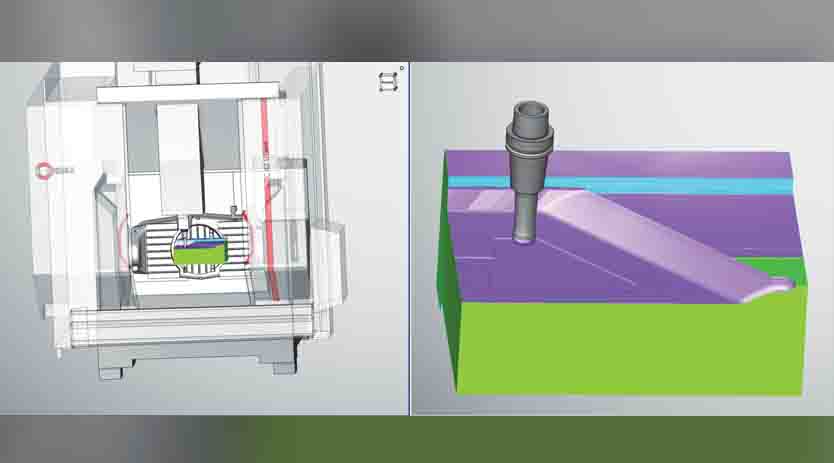

Intec Capital possesses vast experience to effectively cater to the financial requirements of the MSME sector. Intec has an unparalleled expertise in providing loans for acquisition of machinery, loans against collateral and loans for business functioning with a focus on growing sectors of the economy. Over a period of almost two decades, Intec has been recognised for offering innovative and customer-friendly financial solutions across the SME sector.

The company has expanded its unique business model to meet almost all the financial requirements of SMEs to grow their businesses. Goel informs, “Intec Capital works on a sound business model that focuses on building and nurturing long-term relationships with their customers that in turn growth.”

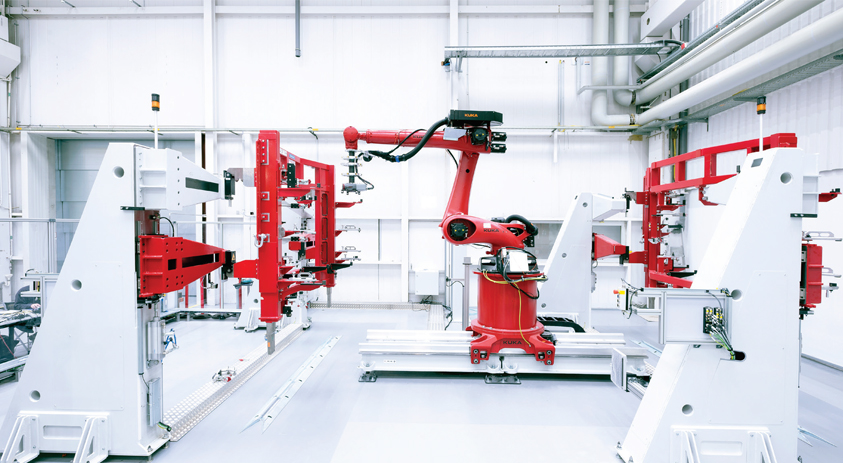

Siemens Financial Services (SFS) is an international provider of business-to-business financial solutions. SFS helps facilitate appropriate finance solutions with specific asset expertise in the energy, healthcare, industry, and infrastructure and cities markets.

According to Sunil Kapoor, CEO, SFS India, “Every business is different, and their challenges are unique to them. Hence, one should look at the big picture and take holistic decisions based on parameters like industry type, type of business, end customer benefits, etc. Owing to our deep understanding of the industry, its challenges, and the technical solutions, we believe that we are well placed to meet the needs of this sector.”

Challenges MSMEs face in terms of financing

A big challenge: To prove credit worthiness

MSME shares 8 per cent of GDP but at the same time it takes care of 45 per cent of manufacturing output and 40 per cent of exports of the nation. This is a substantial contribution by in terms of global scenario. Nitin Wakode, Associate Vice President PSG, Onward Technologies Ltd, explains, “If one looks for almost 10 years back, MSME has very tough time to compete with industrial houses in terms of multiple competitions in market, finances and even ease of business. Today, there is drastic difference the way MSME units get priority as well as support. There are various schemes available from government as well as banks.”

Another big challenge MSME faces are to prove credit worthiness or some sort of rating in terms of business performance. NSIC has introduced a special scheme Performance and Credit Rating Scheme; main objective of the scheme is to provide a trusted third party opinion on the capabilities and creditworthiness of the MSMEs so as to create awareness amongst members about the strengths and weakness of their existing operations. Rating under the scheme is being carried out through empanelled rating agencies i.e. CRISIL, CARE, ONICRA, SMERA, ICRA and Brickwork India Ratings. Under this scheme, rating fee payable by the micro and small enterprises is subsidised.

Challenges: Working capital, marketing capital and cash flow

Wakode informs, “Though there are multiple schemes launched by government and banks there are still challenges with MSME sectors for finances in terms of working capital and marketing capital. Someway industry associations need to work with government bodies like MSME, NSIC, financial institutions to create the awareness with bank officials as well as industry members and bring ease of business.”

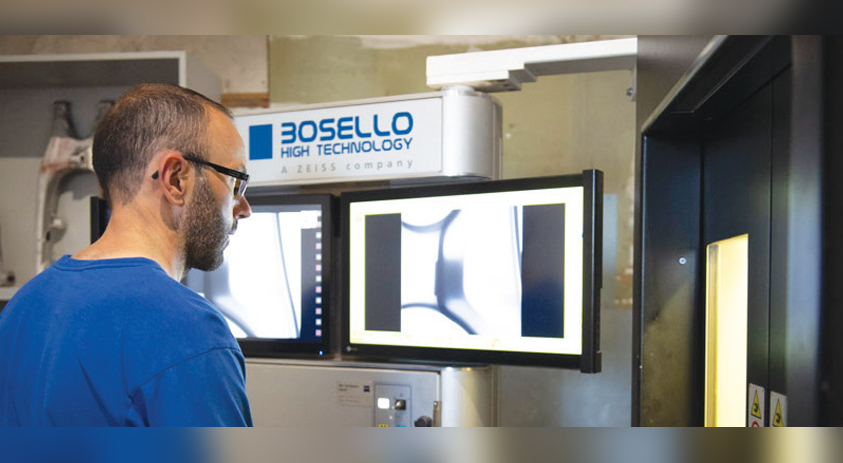

According to Vineet Seth, Managing Director – South Asia and Middle East, Mastercam India Pvt Ltd, “MSMEs usually face two major issues working capital and cash flow crunch. MSMEs are like the middle-class equivalent of the business world. They are recognised as an important driver of growth and employment in the country but due to non-availability of credit history and lack of clarity in business proceedings, the formal banking system does not offer much to them, in terms of financing. Delayed payment from debtors is also a major concern, as this severely affects cash flow and strangles scalability. “

Seth informs, “The lack of in-house or day-to-day financial expertise in most small organisation means that even smaller issues blow up into bigger financial crisis. Most organisations simply lack the formal training and skills necessary to manage the finances of a growing organisation. While some companies actively engage accounting professionals, a large number tend to involve them only to fulfil statutory obligations. Despite the efforts of government institutions, there is a huge demand-supply gap in small enterprise financing. While financial institutions require collateral or equity both of which these small enterprises cannot really offer the finance gap keeps widening.”

Adequate credit for expansion of business is a challenge

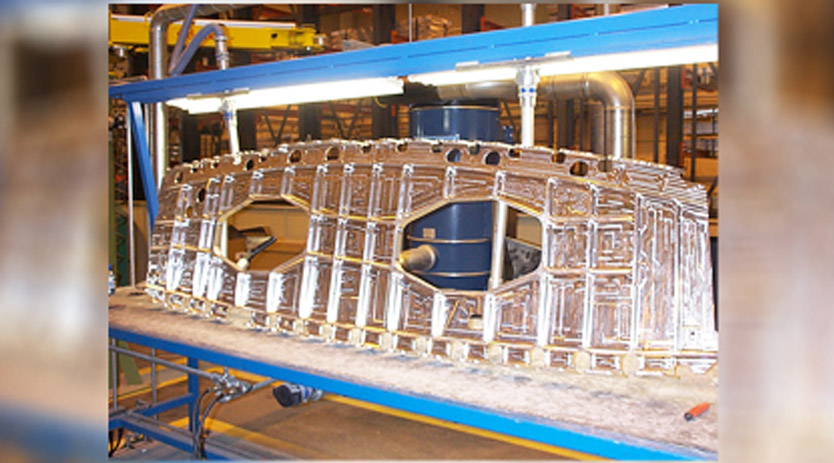

MSME sector has always discussed problems arising due to scarcity of capital. Nearly all banks prefer to lend to MSMEs only against collateral. Current trend is that majority of lending to MSME sector is against property mortgaged by promoters, owners or partners of MSME unit to the bank. A significantly large chunk of MSME loans between Rs 3-15 crore are actually nothing but Loan Against Property (LAP). This trend is actually because of the risk framework adopted by banks to build secured loan book which leads them to lend only against collateral.

Collateral can be either property, gold or bank FDs. Therefore, they end up accessing finance mostly through mortgage of property whereby banks comparatively, rely more on the security given than the understanding of the business and the strength of it in terms of cash flow. Mahesh Tyagi, Managing Director, Heller India says, “In this scenario, the majority of MSMEs with absence of collateral find it difficult to access credit through formal sources. The MSME sector faces a major problem in terms of getting adequate credit for expansion of business activities. Latest information on credit disbursed by banks shows that out of a total outstanding credit of Rs 26,04,100 crore as in November 2017, 82.6 per cent of the amount was lent to large enterprises. The MSME sector received only 17.4 per cent of the total credit outstanding.”

Dependency on private financing makes the situation critical

It is a well accepted fact that the growth of MSMEs only could be the major driving factor of Indian economy for the next few decades as it could only boost collective growth which predominantly depends on formal financing systems such as banks and other institutional bodies. K. Manickam, Managing Director, CAD Macro Systems states, “As MSMEs still have to go a long way in terms of demanded regulations, their dependency on private financing makes their situation more critical due to the interest rates which are 5 to 7 times higher than formal funding systems. By and large, unstable market conditions, cut throat competitions, poor awareness on government schemes and lack of ROI proportion are also found to be the added challenges in this sector in terms of financing contest.”

Budget proposal on MSME financing

MSME- a major engine of growth and employment

MSME is termed as major engine of growth and employment generation which reflects great respect and importance of MSME to economy. Finance Minister Arun Jaitley announced Rs 3,794 crore allocation to MSME sector for credit support, capital and interest subsidy on innovation. Wakode, however feels that actual benefits are not that tangible. Most of the exiting schemes are discussed except online loan sanctioning facility for MSMEs to be revamped for prompt decision making by the banks. Due to up bit market scenario and healthy environment in business can be considered as hope towards MSME financing.

On the other hand, Seth feels allocated Rs 3,794 crore. is a good step towards supporting the MSME sector in growing to the next level. He adds, “With the introduction of GST last year and the recent demonetisation drive, it is expected that an enhanced formalisation of the MSME sector will be visible, in the coming years. This step alone will help financial institutions offer loans quicker based on the data that is being generated; while also reducing risks of NPAs and bad debts in the process.”

Budget will make better environment

Demonetisation and the introduction of GST is helping make policies which will benefit the micro and small medium enterprises, the corporate tax rate to 25 per cent for companies with annual revenue of up to Rs 250 crore which results in more surplus. Tyagi said, “With the relaxation extended by government in latest budget will definitely make the better environment for MSME to invest in increasing their production capacities and spend on R&D.”

Fund allocation is appreciable

Manickam says, “The proposed lending target of Rs 3 lakh crore by the central government under MUDRA scheme and the extended scope of 25 per cent corporate tax band to Rs 250 crore turn over companies are unique advantages in this budget 2018-19 pertain to MSME sector. Apart, the fund allocation of Rs 3,794 crore for credit support, capital and interest subsidy are really appreciable in this current budget.”

Intec Capital works on a sound business model that focuses on building and nurturing long-term relationships with their customers that in turn growth.

Sanjeev Goel,

MD, Intec Capital Ltd

Owing to our deep understanding of the industry, its challenges, and the technical solutions, we believe that we are well placed to meet the needs of this sector.

Sunil Kapoor,

CEO, SFS India

Though there are multiple schemes launched by government and banks there are still challenges with MSME sectors for finances in terms of working capital and marketing capital.

Nitin Wakode,

AVP PSG, Onward Technologies Ltd.

With the introduction of GST last year and the recent demonetisation drive, it is expected that an enhanced formalisation of the MSME sector will be visible, in the coming years.

Vineet Seth,

MD– South Asia and Middle East, Mastercam India Pvt. Ltd.

The MSME sector faces a major problem in terms of getting adequate credit for expansion of business activities.

Mahesh Tyagi,

Managing Director, Heller India

The fund allocation of Rs 3,794 crore for credit support, capital and interest subsidy are really appreciable in this current budget.

K. Manickam,

Managing Director, CAD Macro Systems

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

English

English Hindi

Hindi